November 20, 2018

Let us start with the conclusion:

Conclusion: There is no change in our forecast for GDP growth and inflation, both decelerating in the US during the 4th quarter (Q4) 2018. Therefore, the Federal Reserve (FED) will be tightening into a “slowing economy with lower inflation.” The result of such move could be very negative for the real economy and financial markets. Perhaps the FED should check first with the European Central Bank (ECB), who has some experience in tightening monetary policy into an economic slowdown. For those who do not know or do not remember, it didn’t work well for the European economy and markets. We already discussed the need to raise rates to build a much-needed reserve for the next crisis in previous Market Commentaries. There is no need, however, to create a crisis to build that reserve.

The Fed and investors should be looking at the yield curve and analyzing the overall market behavior for a very simple reason: financial markets are a forward-looking mechanism to anticipate future economic behavior. Is it a crystal ball? No, but it is better than analyzing backward-looking data and assuming that because economic data was friendly last week, or last month or last quarter, it will continue to be friendly in the future. If this were the case, we would not have economic cycles. Instead, growth would always be accelerating.

It is true that the economy is on a healthy streak and so is unemployment, inflation and consumption. But forward-looking financial markets are suggesting a different scenario more in line with our forecast for growth and inflation, Industrial Production, Manufacturing, New Orders and Capital Expenditures (all decelerating year-over-year (YoY)). Let’s consider the following:

- CRB Commodities Index: There are approximately 19 commodities in the index, which is a good proxy for inflation expectations. The index peaked in May and it moved lower by -8.5% to Monday’s closing price.

- Copper: 100% industrial commodity! Since its peak in June it moved lower by -15.2% to Monday’s closing price.

- 10 year US Treasury yield is falling from its 3.24% high on October 5th to its current 3.05%. Almost -6% drop in yield. In this case, the falling yield is not an indication of economic strength. The FED is geared to increase short-term rates in December, while longer-term rates have trouble moving higher. This fact alone should be a warning sign for the FED to figure out why traders and investors are not in sync with their tightening monetary policy.

- Consumer Discretionary and Technology sectors, darlings of the stock market during 2017 and early 2018, have lost their glamour. These two leading sectors of the real economy have suffered so much damage lately that they lost their short and midterm uptrends. And if market behavior does not change soon, the likelihood is that both are at the risk of losing their main trend, which remains barely positive.

- During the last 30 days, three of the four leading sectors in the U.S. stock market are defensive in nature. This, combined with the previous point, indicates a clear trend for a defensive strategy as opposed to stocks tied to growth and high beta. Certainly, this shows very little or no confidence in forward-looking stock prices.

- High beta stocks linked to growth and the leading sectors of the economy lost -8.3% during the last 3 months, while low beta stocks linked to defensive sectors lost -1.1%.

- On the credit side, junk (JNK) and high-yield (HYG) bonds are under pressure. HYG dropped -5.6% from its peak in early January to Monday’s closing price. And almost -4% since September 28th. As for JNK, the drop is even greater. Over -6% since early January and over -4.1% since September 28th. What a coincidence that at the end of the economic cycle, when both GDP and inflation are slowing down, shorting or at least avoiding high yield and junk bonds is the appropriate strategy.

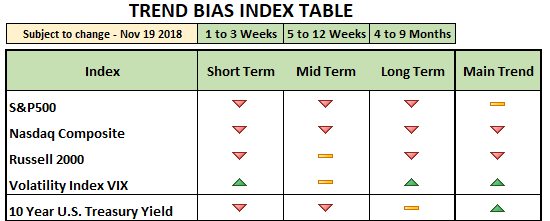

- Volatility swings are increasing, a sign of investors’ uncertainty. The S&P500 Volatility Index (VIX) is trading at lower levels than February, but still comfortably above the level needed for the uptrend in stocks to resume. Therefore, we would like to see these levels settle lower before we take the Caution Tape down.

In summary, as of today’s closing the bulk of the evidence is not bullish for stocks in the U.S. If you think you have seen enough volatility, wait until you see what happens when the Fed inverts the yield curve.

If markets were in a low volatility, up-trending environment like in 2017, all of the above is meaningless. But if markets are acting in a volatile manner, all of the above is relevant and capital preservation, not performance, should be a priority until volatility fades away. If the Fed reconsiders its plan, lower volatility can be achieved overnight –so to speak.

The S&P500 and the Nasdaq seem to be ready to test the October lows. Although an oversold bounce is possible, if support does not hold, a more serious breakdown would be likely.