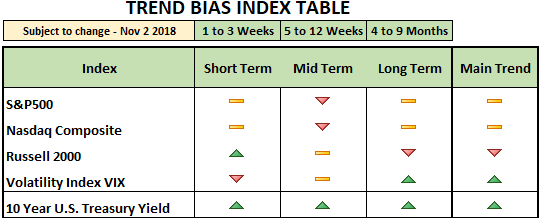

November 2, 2018

In my recollection, the 10 year TSY yield is a very effective mechanism to forecast economic behavior 6-12 months ahead. Furthermore, an understanding of the TSY yield curve can provide clues of future economic growth or lack thereof. This should be a very helpful tool while determining interest rates and the timing to act on them (hiking or lowering) and by how much.

From a fundamental point of view, the Fed is correct in their campaign to raise rates. We do not want the Fed to make the same mistakes made by the European Central Bank (ECB) and the Bank of Japan (BOJ). But timing matters. Jerome Powell should not act like Janet Yellen when she delayed a rate increase despite a bull market and high liquidity ahead of the 2016 election. There is no need for Mr. Powell to do the same and it does not look like he will.

The U.S. is not a 1% GDP growth economy in need of liquidity through monetary policy. This is an economy in which there is real private investment, helped by tax cuts and less regulation. The economy only started to grow on solid footing recently and only now is it, after many years of no growth and wage inflation, benefiting not just the wealthy, but Middle America, too.

On the other hand, the economies in Europe and Japan continue to weaken while liquidity is high and rates are probably at all-time lows. The ECB and BOJ have very little, if any, ammunition to combat their economic misfortunes. We used the ECB and the BOJ to build the case for the Fed and why Mr. Powell should continue increasing rates moderately: to build a cushion to effectively increase liquidity during the next crisis in the U.S.

The key word is moderately. Additionally, there are two variables that matter: (1) timing and (2) the size of the interest rate increase. And this is why they matter:

- Discrepancy between the financial sector and the 10Yr Yield. While the 10Yr Treasury Yield has rallied since the beginning of 2018 (approx. +27%) the financial sector has moved lower, making it one of the three worst performers this year. This is important because in expanding economies, yields and financials move up together. The reason is very simple: banks benefit as long-term interest rates move higher and the spread between short term rates and long term rates widens. The flattening yield curve and its narrowing spread is the problem for banks’ profits and the real economy. A narrowing spread is not the ideal environment for banks’ profits and the economy. Even worse, an inverted yield curve, which is associated with economic recessions, is the risk. In early January 2018 the spread between the 2 year and the 10 year TSY yield was approx. 55bp. It’s now 30bp. Not only has the yield curve flattened since early October, but the 2 year, 5 year, and 10 year yields are trending down regardless of today’s move higher (the 30 Year is the exception). If the downtrend in yields continues and the Fed raises the short term rate, the yield curve flattens even more and may become inverted. An inverted yield curve occurred right before the Internet Bubble (excess valuations) and the Sub-Prime Mortgage crisis (excess leverage). Now, the U.S. is withdrawing from excess liquidity, while the rest of the world is still running on it. Given where the U.S. economy is now, a crash is unlikely. But, if the Fed misses the timing and errs on the size of the rate increase, an inverted yield curve could actually trigger a more widespread crisis.

- Bond Market Forecast. In our experience, the bond market usually leads the stock market. Presently, the 10 year Treasury Yield is building lower lows, seemingly indicating lower GDP and inflation for the last quarter of 2018 (in line with our forecast for a slight slowdown in the U.S.). If that trend in yield reverses, however, it would be an indication of a stronger economy going into 2019 and a green light for the Fed to increase rates at a much more comfortable pace. Especially, if the yield steepens. Although we don’t think this will be the case.

Conclusion. Although it is clearly understandable why Mr. Powell has to continue to increase short- term rates, executing the plan moderately and timely is as important as building the needed buffer to fight the next crisis. We hope the Fed is looking at and understanding the behavior of the yield curve and how to manage it. Otherwise, the Fed itself may drive us into the next crisis in trying to build said buffer.