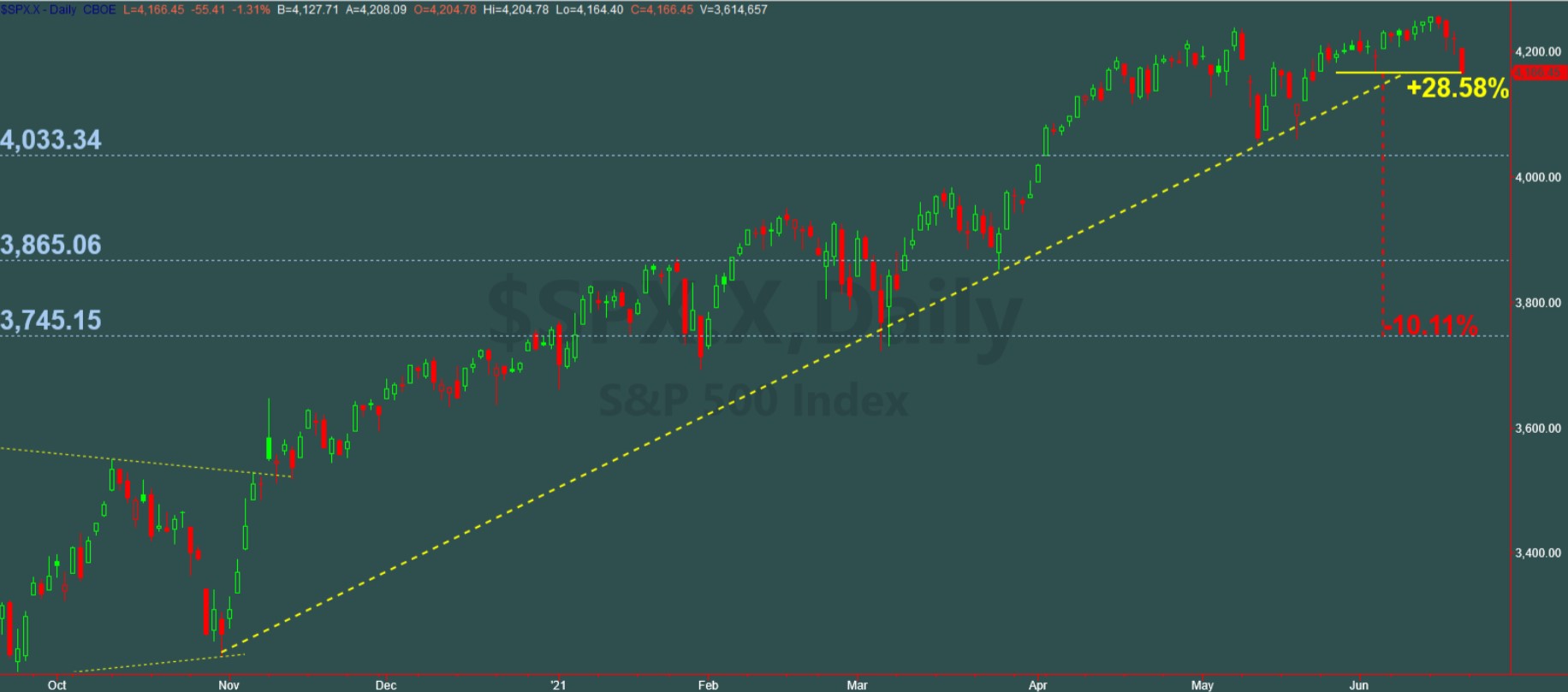

Last week the FED acknowledged inflation and investors sold commodities, materials, financials and industrials. Non-sense. All these sectors will benefit from higher inflation. The S&P500 Index is up 28.5% since mid-October without a significant pullback or consolidation (yellow dotted line on the chart). Even in secular bull markets a 38% to 50% retracement of the previous uptrend is perfectly normal (3,865.06 to 3,745.15 on the chart).

Last week, industrials, financials, materials and energy, all 2021 leading sectors of the S&P500 broke down. Technology has been catching up with the rest of the market during the last two weeks and it is still holding up fairly well. We have noticed that participation in the stock market has narrowed to levels that could make the uptrend unsustainable unless participation broadens again.

This does not mean that a bear market is at sight, at least not yet. In addition to all of the above, the behavior of the 10 year Treasury yield breaking down, while short term rates moved up with the USD, makes us believe that a 7% to 10% pullback “could” be possible on the S&P500 from current levels (red dotted line on the chart). If it were to happen, since:

- Credit markets show no signs of stress.

- The main trend of volatility is bearish.

- The FED is on the stock market’s side.

- In our opinion the 10 year Treasury Yield is on a bullish uptrend regardless of the recent break down.

- And the main trend of both S&P500 and Nasdaq is bullish.

- Then, a pullback could present a new buying opportunity –all things being equal.

If a pull back or consolidation takes place, a recalculation of all Greenwich Creek’s variables will be necessary to confirm the buying opportunity.

Do you have a risk management strategy and a proven repetitive investment process to profit in bull markets and protect capital in bear markets? Check our website for more information about how we manage investment portfolios:

www.GreenwichCreekCapital.com

For High Net Worth Portfolios

And

www.FreedomInvest.com

The Active Asset Management Platform for Small Accounts.