January 23, 2019

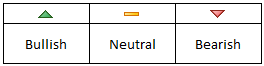

In our last post on January 7th we said: “In our opinion the S&P 500 Index can move from current levels (2531.94) to a range from 2600 to 2750. If it gets there and a breakout occurs with higher volume and lower volatility, the breakout may be credible. But if it gets there on lower volume and unchanged volatility, most likely the move is a head fake and the index will roll over.” Please click here if you would like to read more details.

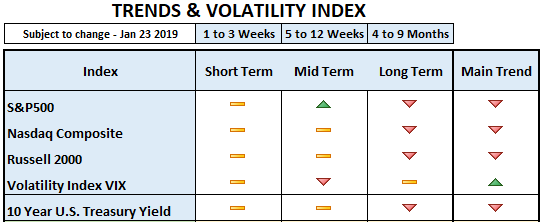

Yesterday’s closing price for the index was 2632.90 and Friday’s closing price was 2670.71. Consistent with our previous view two weeks ago: This is the moment of truth. For the uptrend to continue we would like to see lower volatility, increasing volume on “buy” days and prices moving up. Without suggesting that the US economy goes into a recession and a secular (long term) bear market, yesterday’s selloff may be an indication that the uptrend has run its course.

Yesterday, global stocks dropped sharply, including emerging markets, which is a move in agreement with a world economy that continues to slowdown. In the US, the profit cycle seems to have peaked in the 2nd/3rd quarter 2018 (24.5% and 24.2% EPS growth respectively), slowing down in the 4th quarter 2018. At this point, growth, inflation and profits in the US are all decelerating. US government Treasury (TSY) yields dropped sharply, too. Money moved mainly from economically sensitive sectors of the stock market, seeking refuge in the Treasury. An overbought S&P500 Index moved down, while an oversold volatility index moved up. If this trend continues, the late December, early January rebound, may be over.

Do not make the same mistake many investors make in being afraid of missing the bull market, remaining invested instead of protecting capital. Have a trade plan and trade your plan. In our January 7th post we provided both possible scenarios: (a) a breakout and continuation of the uptrend and (b) a breakdown and continuation lower. Perhaps this is the time to avoid being brave, while protecting your capital and saving some dry powder for the next leg up. And sooner or later the next battle between the bulls & bears will come. Just be patient and manage your risk.

You may click here to access more information about our analytical quantitative and qualitative process: “The Roots of Our Process,” which allowed us to avoid the internet bubble, subprime crisis, a brief bear market in 2011, correction in 2015 -2016 and the current correction/bear market.