September 9, 2019

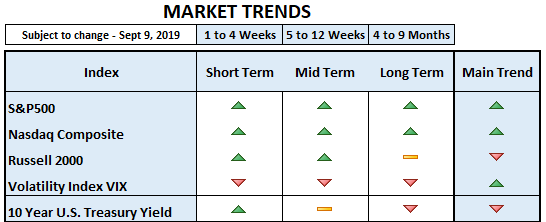

The S&P500 and Nasdaq Composite moved above the narrow price ranges that plagued the month of August. It seems the bulls obtained the upper hand at the end of last week. Now, both are trading above their 50 day moving averages, further strengthening the bulls. The VIX (volatility) Index broke its first support level and is now below 16. Although more volatility is likely, as long as the VIX remains below 16/17 area, it should continue to be positive for equities.

The 10-Year Yield continued to move higher today, a positive sign for the market. Furthermore, yield moving up is usually a good indication of an economic recovery. The most popular section of the yield curve is the spread between the 2Yr and 10Yr, followed by institutional investors. Said spread, inverted throughout the last few weeks, returned to normal today. This means that the 2Yr yield is again below the 10Yr yield, which should ease investors’ anxieties about an incoming recession. Remember, an inverted yield curve is associated with a future recessionary period.

So far, this has certainly been a volatile year. Regardless of Brexit, trade uncertainty, and unpredictable tweets, the US stock market (mainly S&P500 and Nasdaq Composite) remains in a strong long-term uptrend. In our opinion, the weakness we’ve seen so far, is merely a consolidation, which should serve as a bullish continuation higher and resumption of the uptrend at a certain point.