October 9, 2018

In our last market commentary, we discussed the longer-term risk for the market. We explained that credit, foreign government and corporate debt and deficit, are the main risks for financial markets and the world economy. Foreign governments and corporations have issued massive amounts of U.S. dollar denominated debt since the mortgage crisis, which is now becoming very difficult to honor due to a stronger U.S. dollar and the weakening of their local currencies.

The Federal Reserve (Fed) is most likely the main immediate risk for the U.S. stock market and the economy. If the Fed increases short term rates by too much, they may cause the yield curve to invert. An inverted curve usually signals the end of an economic recovery and the beginning of an economic contraction. Despite the Fed’s interest rate increase last month, the spread between long and short term rates widened last week, as the 10Yr. Treasury Yield rallied. A steeper yield curve is good for the economy and the stock market. Since we are not fighting out-of-control inflation yet, last week’s rally in long term yields is most likely signaling a strengthening economy.

Then why the sell-off in the stock market? In our opinion, investors are worried about the Fed’s timing. The Fed has the power to contract the economy, killing the stock market rally by increasing rates too much or too late. Their decision to raise interest rates, while US inflation and GDP growth slow in Q4 (as they are expected to do), could be problematic. Slower growth, even if it’s only slightly, will hopefully mean “dovish” (non-aggressive) monetary policy.

Since early 2018, we have recommended a reduction in exposure to high beta and growth companies in favor of lower beta. It’s important to note that during the last few weeks we’ve seen some rotation of capital into some of the most conservative sectors of the economy. For the time being, we are sticking to our forecast that inflation peaked in Q2, moving lower alongside US GDP growth in Q4. But we may change our forecast at any time if commodity prices keep pushing up.

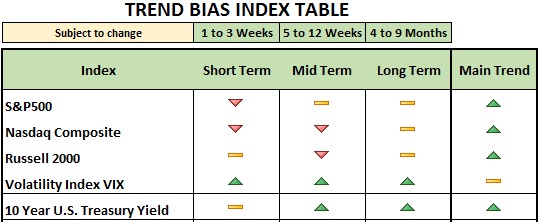

We have avoided Emerging Markets and Europe because the U.S. market and its economy keep decoupling from the rest of the world. We are not in a bear market yet and if the steepening of the yield curve is sustainable, it should be good for equities and the economy. The bond market is helping by pushing yields higher and steepening the yield curve, but the Fed needs to at least come up with a more dovish message to ease investor anxiety. Although the US economy is strong, there are some early indications of weakness we should not ignore. We still believe that the US economy is transitioning from accelerating growth and inflation to decelerating growth and inflation in Q4. But we are not calling for a recession.

Periods of transition can be confusing and volatile in the market. Stay tuned for our next commentary.