Important points since our last market recap:

- The market seems to be bullish on Trump: Investors watched closely as the U.S. and China held trade talks the last two weeks of August. Furthermore, the U.S. and Mexico came to an agreement on a trade deal, which Canada seems to be interested in joining. Despite potential slower growth to come in the second half of 2018 in the U.S. due to a global economic slowdown, the market seems to be taking these talks positively. Slower growth, even if it’s only slightly, would hopefully mean a dovish Fed. Dovish monetary policy would give the U.S. economy a breather and while we would probably see long-term yields moving lower, we can expect the stock market to remain bullish if this scenario plays out.

- Interest rates: Short-term rates reflect monetary policy and are influenced by any commentary or actions from the Federal Reserve. Long-term rates reflect what the market can tolerate in terms of interest rate moves. In other words, if the economy is not firing on all cylinders, then long-term rates will move lower, flattening the yield curve, an indication for the Fed to mind its rhetoric, stance, and actions in terms of hiking rates. Although Fed Chairman Jerome Powell signaled two more rate hikes this year, the market reacted bullishly to his comment that they will be subject to the continuation of strong growth (it sounds like a dovish Fed, which as we saw, was good for the market). Furthermore, he mentioned there is no reason to think the economy is at risk of overheating at this point (also dovish). The 10Yr Treasury Yield and the behavior of commodities seem to confirm slower growth and a dovish Fed. If the Fed decides to move forward with further rate increases, long-term yields would probably still move lower. If this is the case, we may find ourselves with an inverted yield curve. We know the Fed has the power to contract the economy, killing the stock market rally by increasing rates too much or too late. Hopefully, they’re looking and understanding the balance between short and long-term rates in the yield curve, important in understanding future U.S. economic growth (or lack thereof).

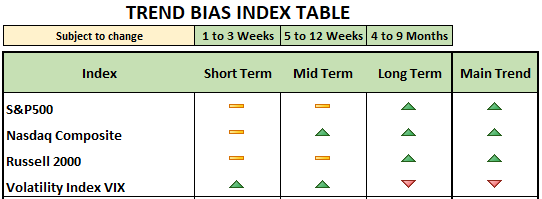

To conclude, while we started the year with exposure to offensive sectors (like consumer discretionary and technology), we’ve merely reduced those positions. We’ve added some defensive sectors (like utilities and real estate) as we navigate the transitory period into an economic environment of slower growth and lower inflation in the U.S. As I mentioned in my last market update, this transitory period doesn’t mean that we expect a bear market in the near horizon. Furthermore, from a technical perspective, we don’t see any weakness to suggest a bear market either (although the uptrend is not as strong as 2017’s run). However, if the Fed moves forward with their path to interest rates normalization (read interest rate hikes) and asserts a hawkish stance, we would certainly expect the market to take that bearishly, a short term bearish cycle.

Last but not least: ISM Manufacturing Index in the U.S. reached a 14 year high. Simply put, wage inflation is slightly up while inflation is slightly down, which should translate into higher purchasing power. In terms of macro, this number means that (i) although global growth and inflation are slowing down, the divergence between the U.S. economy and the rest of the world should continue. (ii) U.S. growth relative to the rest of the world continues to support a divergence in central bank monetary policy. (iii) It supports a higher U.S. Dollar, too. (iv) Therefore, headwinds for Emerging Markets should continue, which brings us back to our point 1 above, “The market seems to be bullish on Trump” and the trade agreements he is pursuing. But even in this seemingly bullish scenario, the Federal Reserve should be careful with its interest rate policy implementation because all this is happening while economies are slowing down, perhaps even the U.S.