January 4, 2019

Did the selloff take us by surprise? Not really. We’ve been talking about a decelerating U.S. economy and inflation alongside the rest of the world since early 2018. More specifically, we mentioned that the U.S. economy and inflation were going to peak in the 2nd Quarter 2018, and it did. And from then on, it was going to join the rest of the world slowing down, and it did. Click here to access our post from December 5th in which we discussed the mistake the Federal Reserve (Fed) was likely to make by hiking rates in a slowing (but not recessionary), non-inflationary economy. And they did it! The Fed increased the overnight rate by 0.25% and now financial markets are probably discounting the likelihood of a recessionary economy in the US.

Let’s try to gain some perspective on market behavior on both stocks and Treasuries (bond market). Yesterday, the stock market in the US sold off on bad news from Apple Inc. (warning of lower iPhone sales in China, the 2nd largest economy in the world). Since the beginning of October, the S&P 500 Index lost about -20% to December 24th. The Nasdaq Composite lost about -23% and Apple lost about -37% in the same period. In 2018, China (Shanghai Stock Exchange Composite Index) lost about -30% of its market value. Should we be surprised regarding Apple’s warning of lower sales? Investors in the US have been anticipating “bad news” (not only from Apple) for at least 3 months now!

The same concept applies to yesterday’s ISM Manufacturing warning: the lowest level in 2 years while new orders dropped 11 points. From early November to December 19th (the day the Fed increased rates), the 10 year Treasury yield (TSY) dropped over -14%. It is now down -20%. Should we be surprised by the latest reading of ISM Manufacturing? Of course not! The TSY has been announcing lower numbers for almost 2 months now. Lower yields are associated with lower economic growth. And the Fed could not pick up on the signal? Today’s unemployment report showed more jobs were added than expected, coupled with higher wage inflation. Higher wage inflation in a slowing economy means businesses pay their employees higher wages, with likely lower sales growth. The result of this scenario is a net contraction in corporate profits. Will Jerome Powell continue his tightening strategy into a slowing US economy? Best recipe to crash the US economy and bad news for the global economy (stronger US dollar?!).

So far, the S&P 500 and the Nasdaq Composite have not been able to regain the lows of February and March / April 2018, which may be indicative of a test of December lows in process. While TSY yields are moving down, Gold and the Japanese Yen are moving higher during the last month all in perfect harmony. From a macro perspective, it makes a lot of sense. Both can be seen by investors as safer investments. Gold thrives in lower yield environments and it has been out of favor during the last few years, but that perception may be changing now that the two largest economies in the world are slowing down. Chinese manufacturing provided a reading below 50%, which is associated with contracting economies. If the two largest economies are slowing down, equity valuations should also adjust down.

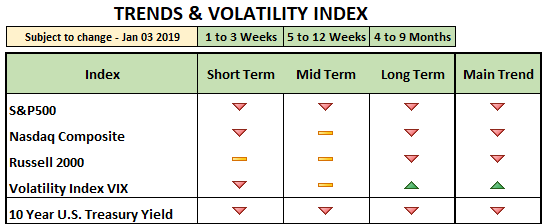

Conclusion: Main global financial markets have been in a downtrend since January 2018 and US markets since 3 months ago. We have been announcing a slowing US economy since 2nd Quarter 2018 and suggesting a rotation out of high-beta and growth into more defensive sectors of the economy. The strategy provided us with positive returns on both equity and balanced portfolios in 2018. We also comfortably achieved positive outperformance against the S&P 500 on equity investments during the same period.

If you have not done it yet, play defensive. The risk you are facing now is the Fed on a mission to help gravity slow the US economy. Gravity would do a perfect job by itself, but the Fed doesn’t know it. Unfortunately, the overdose provided by Dr. Powell and his Emergency team, who may increase rates again, may end up killing the patient. It is never late to raise cash by getting out of volatile positions in times of uncertainty and save powder for the next leg up. How long will the leg down last? Impossible to know whether this is a short term correction / bear market or more of a secular move. The Fed will decide whether or not this is a cyclical or secular move down. And this is not a good thing…