For today’s weekly market recap we’ll touch on three main points:

- Inflation versus Deflation: The direction of interest rates is one way to measure the strength or weakness of the economy. Inflationary/deflationary expectations control the direction of long-term rates. For weeks, we’ve been discussing the behavior of the 10-Yr Treasury yield, failing to confirm that the U.S. economy will continue to accelerate. Yields continued to fall since our last market update, closing the week at main support. Another way to gain some insight on inflationary/deflationary pressures is by observing the behavior of Treasury Inflation-Protected Securities (TIPS). TIPS, which provide protection against inflation, have been underperforming relative to 30 and 10 year Treasury bonds since February (meaning decreasing inflationary pressures). It’s also interesting to note that bond proxies (utilities, consumer staples, real estate) have seemed to mark bottoms this year. Perhaps the market, as opposed to investors, is indeed expecting lower inflation and growth, seeking return in higher-yielding bond proxies.

- Commodities & Basic Materials: While investors and the FED may expect higher inflation and stronger growth, it’s possible the market may be anticipating a different scenario. We’ve seen weaker commodities throughout 2018. Weaker commodities would make sense if the market expects lower inflation and slower growth. However, up to now, we have only tame inflation and strong growth.

- U.S. Dollar (USD) Strength: The strength in the USD is more than likely responsible for preventing late-cycle leaders, like commodities, from outperforming at this point in the market cycle. The FED’s hawkish monetary policy of raising rates also attracts more investment to the U.S. and the plunge in foreign currencies (Euro, Russian Ruble, Argentine Peso, Turkish Lira, Brazilian Real) have perpetuated a burgeoning USD. The USD’s strength throughout 2018 may be reason enough for a dovish FED (delaying planned interest rate hikes). When the economy has reached full recovery and entered the late-cycle stage of recovery (rising inflation and peaking GDP), we typically see investors favoring commodities and other inflation-sensitive sectors (materials, energy). Despite over 4% GDP growth, low unemployment, strong corporate earnings, rising consumer prices, we aren’t seeing money rotate into the sectors mentioned above that typically outperform in the late-expansion stage.

To conclude…

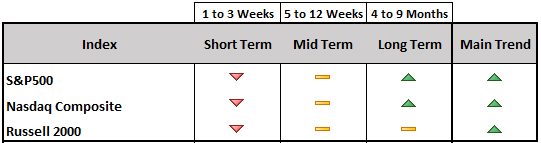

When we look under the hood, we’re still in a bull market, although not quite as strong as last year’s. Strong U.S. economic data and a hawkish FED tell us that the market cycle may have begun its peaking process (which definitely doesn’t occur overnight). Weak commodities, which typically perform strongly at this point in the cycle, pushed lower by a stronger USD, are making pin-pointing where we stand in the cycle somewhat tricky. However, it’s important to keep in mind that not every market cycle repeats itself in exactly the same way, cycle after cycle. We’re still in the gray area in terms of determining the market’s next leg up or down. But since we may be at the peak of the business cycle, it would be prudent to reduce exposure to high-beta (riskier) assets and consider adding some bond proxies. Worst case scenario, if the market breaks down, you’re positioned defensively. Best case scenario, the market breaks out to the upside and you swiftly move into more offensive exposure. Keep in mind this is a transitionary period that should be navigated nimbly as we move forward. Currently, it seems the path of least resistance is to the downside for the 10-Year Treasury Yield. Additionally, volatility seems to be increasing and remember, volatility happens little by little and all of a sudden, all at once. By then, it’s too late to act.