January 7, 2019

Usually, we do not write daily market posts. Sometimes, not even weekly, if there is no change of opinion or we do not have something new to say. But current market volatility merits a separate post from the one we posted on Friday 4th.

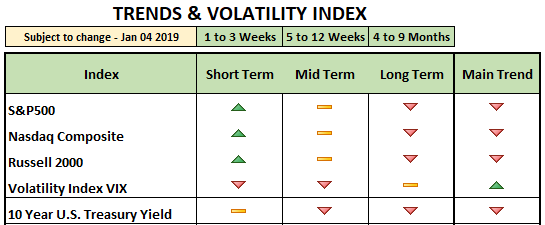

It is always recommendable to have a trading plan and to be disciplined trading it. It makes sense that in bull markets your plan should have a long (buy) bias and in bear markets a short (sell) bias. But then, for different reasons, you may even encounter an undecided market. Let’s take a quick look at the current market:

- The fundamentals of the world economy, including the US, are slowing down. Therefore, stock markets may continue to adjust to lower stock valuations.

- From a macro perspective, the rotation of capital out of high beta and growth into safe sectors, the behavior of commodities, currencies, the Japanese Yen, gold and the US Treasury yield seem to indicate that the fundamentals are correct: the world economy is in fact slowing down with low inflation.

- From a technical perspective, Friday’s US stock market rally took place with very little participation. We measured S&P 500 Index, S&P Mid Cap 400 and S&P Small Cap 600. All together 1500 stocks. After the closing, we found stock participation below 20% in all cases.

- Friday’s volume on both, S&P 500 and Nasdaq Composite, was lower than the previous day and not even close to the volume during the selloff that took place in the second half of December. Volatility remains high. This is a problem because increasing volume, while prices move down and volatility moves higher is associated with bear markets. (The opposite is associated with bull markets: prices moving up with volume also moving up and lower volatility).

- Volatility is increasing. After the market pullback in February-March 2018 the rate of change (ROC) of volatility dropped during April-May, which made possible the next leg up that ended in early October. The opposite is taking place now. After the October-December plunge, the ROC of volatility is increasing, which makes the current market environment riskier.

Friday’s jobs data and payroll gains sent the stock market up, most likely supported by a shift in the Federal Reserves’ (Fed) rhetoric: Powell suggested that raising rates is “on hold.” Perhaps the Fed’s chairman is trying to offset their decision to hike rates into a decelerating economy during the December meeting.

Regardless, our main interest in this market commentary is to prevent you and us from mistakenly interpreting a countertrend bounce for a new leg up in the stock market. Either way, you must prepare in very different ways for one or the other. The fundamental and technical data are supportive of further weakness, but the Fed can move the market in the opposite direction. In fact, they have done it throughout 2008 to 2016. Therefore, to play safe, we are all better off having a plan for either outcome.

Mathematically speaking, in our opinion, the S&P 500 Index can move from current levels (Friday’s closing of 2531.94) to a range from 2600 to 2750. If it gets there and a breakout occurs with higher volume and lower volatility, the breakout may be credible. But if it gets there on lower volume and unchanged volatility, most likely the move is a head fake and the index will roll over. Consider that the worst case for a credible breakout is that you may be a bit late to catch the new leg up. But if the move up is a head fake, this may be the last opportunity you have to get out of the way and protect your capital.

Exactly the same concept applies for the Nasdaq Composite. In our opinion, mathematically speaking, it can move from its current level (Friday’s closing of 6738.86) to a range from 6900 to 7540. Whether the next move is a credible break out or a head fake remains to be seen, but you should prepare diligently for either outcome.

You may click here to access more information about our analytical quantitative and qualitative process: “The Roots of Our Process,” which allowed us to avoid the internet bubble, subprime crisis, a brief bear market in 2011, correction in 2015 -2016 and the current correction/bear market.