June 3, 2019

Investors’ fears were not appeased by this morning’s news that Mexico and China will continue to discuss trade with the U.S. Stocks moved down, while bond prices moved up and yields fell. Needless to say, not a good combination.

The spread between the US T-Bill & 10 Year Note remains inverted, which is a clear gloom and doom message from the bond market to the Federal Reserve (Fed). The Fed must get on the same page with the bond market in order to (a) prevent a meltdown in financial markets and (b) drive the economy into recession. Although the Fed has delivered some “dovish” comments and financial markets are pricing in a July Fed Funds rate cut (and one or two more by January), the Fed needs to make it happen.

During the last month, the Nasdaq moved about -10% and it tested the lows of March today at 7332.92. It is important that the index holds the support line. If it doesn’t, a test of the 7200 may be in the horizon, about -2% drop from current levels.

Antitrust fears in the technology sector served as another negative driver of today’s stock market behavior. The Tech sector is a main component of the S&P500 (about 26%). The fears affected stocks, including Google’s Alphabet (-6.15%), Amazon (-4.85) and Facebook (-7.34%).

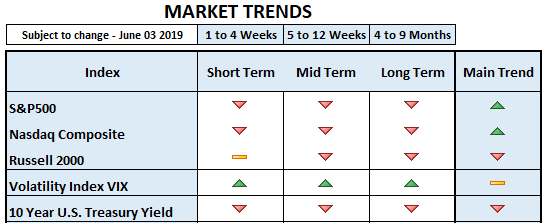

Conclusion: A solid reversal does not seem to be at hand anytime soon, although a tweet or a rate cut may suddenly change the current environment. In the meantime, we are treating this market with respect and allowing our defensive positions to outperform.