April 23, 2019

In our last financial market outlook “A Visit with Dr. Copper”, we analyzed copper as a reliable representation of the world economy. We explained that “copper’s behavior is typically useful as a leading indicator of economic health and the economic cycle.” Strong copper prices generally imply a strong demand for copper. Since the metal has many applications across different economic sectors, strength in copper usually indicates a growing global economy.

In our post, we also briefly discussed the relationship between copper prices and the Chinese economy. China and its stock market have a strong influence on copper prices. This isn’t surprising since China is the largest importer of the metal, consuming about half of the world’s copper. Our fundamental research shows that Chinese growth bottomed last quarter after 8 consecutive quarters of slowing growth. Strong Chinese economic data and a rising Shanghai Composite should continue to have a positive effect on copper prices.

Let’s now take a closer look at copper’s behavior relative to some other players in the market.

Gold, although also a commodity, has been under-performing relative to copper. This further indicates that investors are no longer betting on an economic recession. Investors usually invest in gold for at least one of two reasons: (1) they seek a safe-haven to more defensive areas and/or (2) they seek a hedge against inflation. So far, this year, investors have shown feeble interest in gold. The precious metal has under-performed all major market indices. Furthermore, it’s struggled to gain strength against a strong US Dollar and more recently, a bounce in the US 10-Year Treasury Yield.

Like copper and unlike gold, platinum has also performed strongly this year. Platinum behaves more like an industrial metal than a precious metal. Both copper and platinum are seen as representations of economic health. Investors’ interest in platinum illustrates offensive, risk-on sentiment and confidence in the US economy.

In conclusion, the stock market rally seems healthy and stable under the hood. The recent leadership in the financial sector and strength from transports are certainly encouraging. However, we would like to see more broad participation to include mid- and small-cap stocks moving forward. In addition to broader participation, we would like to see Treasury Yields moving higher to confirm the incoming global economic recovery that copper and platinum may be hinting at. In other words, the strength in copper and platinum should be confirmed by higher yields and lower gold prices.

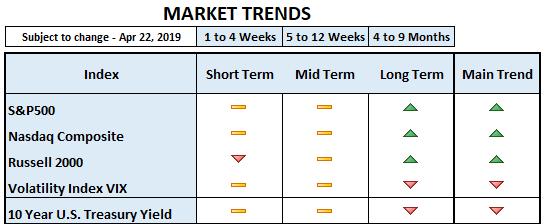

Below is our market trends table as of yesterday’s closing…